1. What is an e-invoice?

E-invoicing is a form of electronic billing. This term is used to define the process by which a transaction between two parties (a buyer and seller) is documented electronically, in order to ensure their trading agreements are being met. The e-invoices are sent through government portals for validation and recordkeeping.

For Malaysia, the e-invoice must be created in the format as mentioned by the IRBM (Inland revenue board of Malaysia), which is usually XML or JSON.

2. E-invoicing rules Malaysia

The IRBM had announced in March 2023, that all businesses that are listed in Malaysia must generate e-invoices for B2B, B2C transactions. However, the issuance of e-invoices is not just limited to transactions in Malaysia, it relates to cross border transactions as well. As of now, no industries are exempted from e-invoice implementation.

An e-invoice for Malaysia consists of 55 fields, which encompass details of the buyer, seller, kind of transaction, product, price, time etc. An e-invoice that is validated successfully, consists of a Unique Identification number (UIN) and a QR code.

3. Implementation timeline

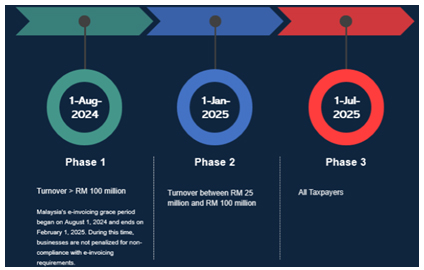

In order to ensure smooth implementation, e-invoice will be executed in phases based on the revenue threshold of the company.

The implementation of e-invoices began in August 2024, for companies of annual revenue more than 100 million.

For taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million, the implementation date is January 1, 2025.

All other taxpayers except the ones whose annual turnover is less than 150 million need to implement e-invoice from July 1, 2025.

Penalty :Failing to issue an e-invoice is considered an offence under Section 120 (1)(d) of the income tax act, 1967. The penalty of non-compliance includes a fine ranging from RM 20O to RM 20,000 or imprisonment for 6 months, or both, for each instance of non-compliance.

4. Benefits of e-invoicing

All the data is stored by leveraging digital tools to create optimized solutions that promote greater efficiency. Thereby reducing chances of error and misinterpretation of data.

Improved security measures to protect against unauthorized entry and potential threats.

Makes it easier to adhere to the law and regulations of the state and maintain the legal standards that are applicable to the business.

Getting substantial work done, with the least amount of resources. Both are important for effective time and resource management in any industry.

It helps in being compliant with the state’s laws and regulations in order to avoid any discrepancies in the future, thereby reducing any legal mishaps.

By providing a structured process flow, that includes validation of the e-invoice, any chance of erroneous transactions is highly minimized. This ensures better recordkeeping and ease of operations.